iowa inheritance tax form

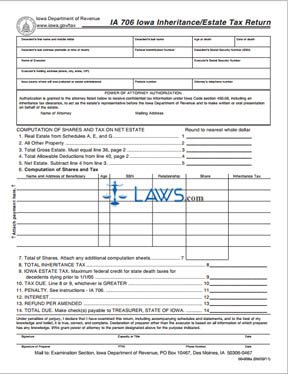

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. Iowa InheritanceEstate Tax Return IA 706.

Learn About Property Tax.

. Ad Free For Simple Tax Returns Only. Iowa SalesUseExcise Tax Exemption Certificate 31-014. Adopted and Filed Rules.

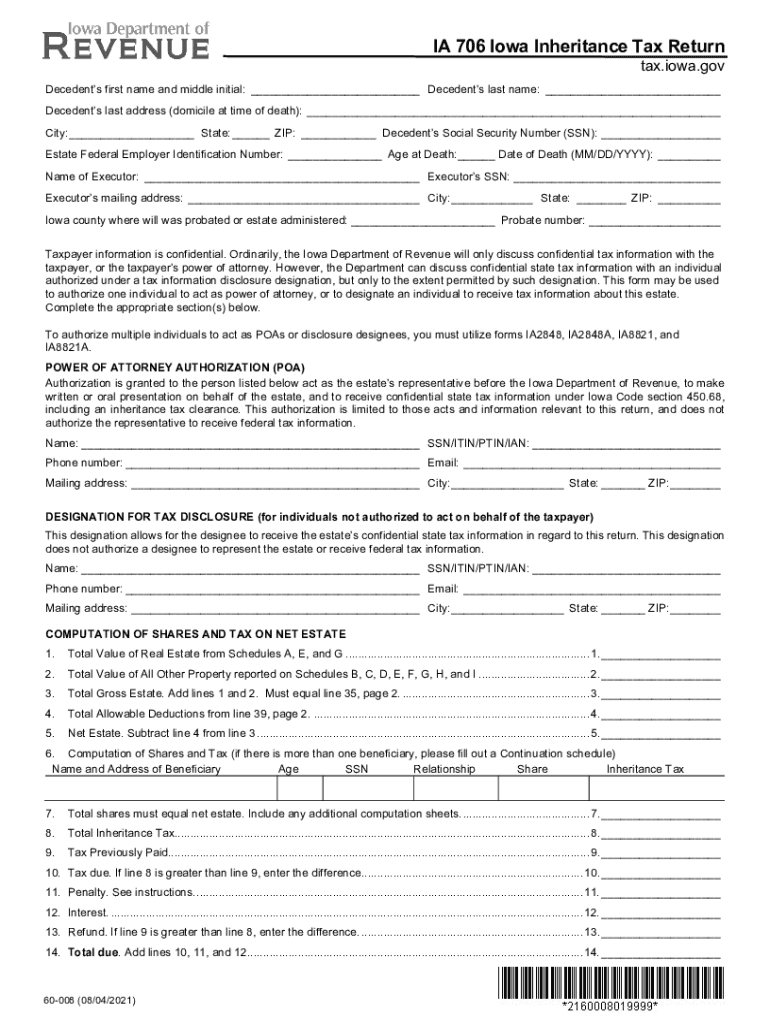

General Instructions for Iowa Inheritance Tax Return IA 706 Return Required. Law. Quick steps to complete and eSign Iowa Inheritance Tax Form online.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. The inheritance tax return provided for in subrule 862 2 must be filed if the gross share of any heir beneficiary transferee or surviving joint tenant exceeds the exemptions allowable in Iowa Code sections 4504. The inheritance tax return must include a list of the property in the estate and the value of the property along with a list of liabilities or debts and deductions.

This document is found on the website of the government of Iowa. In Iowa this means filling out Form 706 and filing before the due date on the last day of ninth month. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

No gift tax is actually due assuming the gift was not over the lifetime exemption. Get Your Max Refund Guaranteed With TurboTax. Appraisals of certain assets may also be required.

Iowa InheritanceEstate Tax Return IA 706 Step 1. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to the beneficiary or heir. IA 706 Iowa Inheritance Tax Return.

Use Get Form or simply click on the template preview to open it in the editor. The document has moved here. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5.

Learn About Property Tax. File a W-2 or 1099. The only form necessary for filing inheritance taxes is Form IA 706.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. The following among others are exempt from Iowas. Start completing the fillable fields and carefully type in required information.

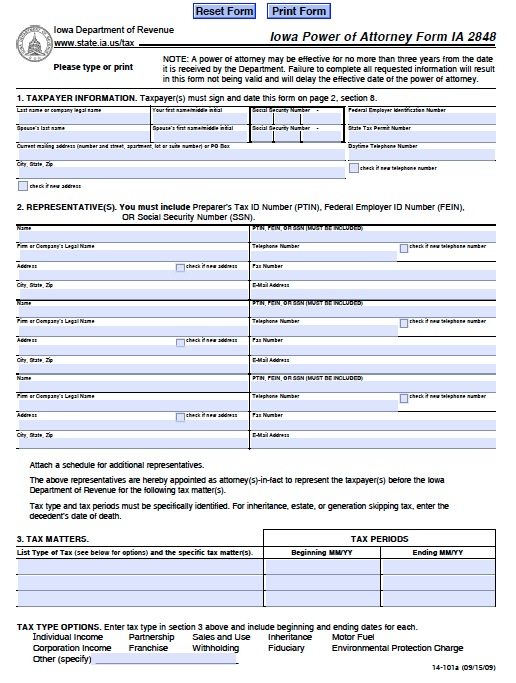

Request for Copy of Business eFile BEN Letter 92-035. File Your Federal And State Tax Forms With TurboTax Get Every Dollar That You Deserve. IA 2848 Iowa Department of Revenue Power of Attorney 14-101.

Marital status of decedent at death. The tax return along with copies of the deceased persons will trust and federal estate tax return if any must be filed with the Iowa Department of Revenue. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. All the beneficiaries of the estate and their respective shares are included.

As you know Iowa does not impose a gift tax. Wills for married singles widows or divorced persons with or without children. Form 709 must be filed to report the 3000 gift that exceeds the annual exclusion.

An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse. A financial advisor can help you minimize inheritance tax by creating an estate plan for you and your family. Sometimes an inheritance tax is used interchangeably with the term estate tax Both are forms of so-called death taxes.

IA 8821 Tax Information Disclosure Designation 14-104. Wills include State Specific forms. For example Indiana once.

File a W-2 or 1099. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms. An inheritance tax return must be filed by the fiduciary of any estate when the gross share subjected to tax without reduction for liabilities of any beneficiary heir transferee or surviving joint tenant exceeds the allowable exemption from such share or if a federal return has been filed.

The tax return is due nine months from the date of death unless the state Department of Revenue grants an extension. Representative Certification Form 14-108. What is Iowa inheritance tax.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. How to Avoid the Iowa Gift Tax. The Iowa Inheritance Tax is filed using form IA706 which can be downloaded from the Iowa State Department of Revenue website at wwwiowagovtaxformsinherithtml.

Learn About Sales. But you still could have an issue with the federal gift tax. Property in the Estate.

If there is a probate court proceeding and an inheritance tax return is necessary it is the responsibility of the administrator or executor of the state to file the return. All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail. The beneficiary subject to estate taxes is personally responsible for filing the tax.

Tax Rate D and Tax Rate E beneficiaries are for various types of organizations. For instance Iowas inheritance tax does not apply if the estate is valued at 25000 or less. Tax Credits.

0 Fed 1499 State. Rates and tax laws can change from one year to the next. Penalty Waiver Request 78-629.

Married Widower Single Divorced The relationship of decedents children to surviving spouse must be included if decedent died intestate. Iowa Inheritance Tax Return. 1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Referredtoin321474215942160450B1450B2450B5450B7602810263.

Therefore it is necessary to first. Also Mutual Wills for Married persons or persons living together.

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

Have You Been Believing Any Of These Myths About Medicaid Medicaid Myths Long Term Care

Iowa Law Relating To Collateral Inheritance Tax A Complete Compilation Of The Iowa Statutes Relating To Collateral Inheritance Tax With Annotations From The Courts Of Iowa And New York

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Free Tax Power Of Attorney Iowa Form Ia 2848 Adobe Pdf

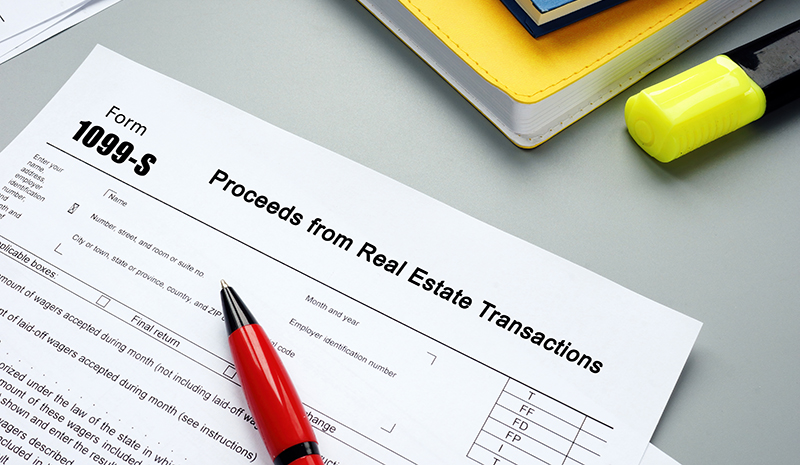

How Do I Put A 1099 S Inherited Home Sale On My Irs Taxes

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Last Will And Testament Sample Form Free Printable Documents Last Will And Testament Will And Testament Letter Templates

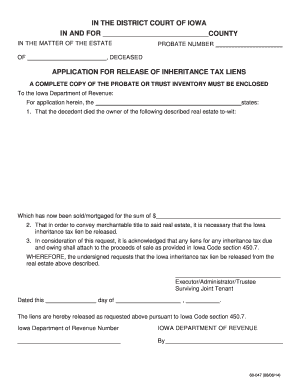

Fillable Online Iowa Inheritance Application For Release Form 60 047 Fax Email Print Pdffiller

Ia Dor 706 2020 2022 Fill Out Tax Template Online Us Legal Forms

Calculating Inheritance Tax Laws Com

Have You Been Believing Any Of These Myths About Medicaid Medicaid Myths Long Term Care

![]()

Have You Been Believing Any Of These Myths About Medicaid Medicaid Myths Long Term Care

How To Make Your Own Will And Testament In Texas Will And Testament Last Will And Testament Writing

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller